While the homeownership market (freehold and condominium housing) continues to keep crews busy, “PBR” housing remains a “someday maybe” priority for many a Town Hall/private developer; and the reality is, it’s been that way for the last 50 years.

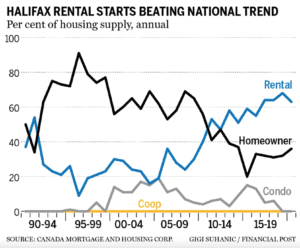

In their recent article for The Financial Post, Murtaza Haider and Stephen Moranis point out that Halifax has been bucking the trend.

Now, before we get hate mail (although…it might still happen) reminding us of the incredible housing shortage in the city we want to say:

Yes. Absolutely, the growing demand for rental housing (particularly affordable and attractive rental housing) continues to outpace the actual development of rental housing.

The fact remains, however, that rental housing in HRM dominates residential construction. So, what is at the root of the focus on rental development? A number of factors, but there are two that Haider and Moranis cite which certainly grabbed our attention.

Halifax’s housing initiatives deserve examination since we believe that restricting landlords to rent raises by a certain level, also known as vacancy decontrol, and the introduction of the capital gains tax have been instrumental in constraining the supply of rental housing.

John Dickie, president of the Canadian Federation of Apartment Associations, pointed out that “until recently, Nova Scotia did not have rent control at all for rental apartments.” The exception was manufactured home lots. Vacancy decontrol was only introduced as a temporary measure in response to COVID-19.

Halifax’s success with rental housing construction demonstrates how public and private entities may collaborate to build sufficient rental housing in places where the demand for rental housing is high. An absence of rent controls in the past, supportive socio-demographics, and imaginative homebuilders and rental investors have been critical to resolving the rental housing challenges.

To learn more and take a look at the full report we recomend checking out the full article from Murtaza Haider and Stephen Moranis here or visiting thier fantastic site at https://hmbulletin.com/